This ranking considers both quantitative factors like NPV and IRR, and qualitative factors such as strategic importance, market positioning, and competitive advantage. The formula can be adjusted based on whether using initial or average investment values. There are two methods, and one option is to combine them both and use the average. This approach then becomes technically a multiple-based approach, because of the way it works. (The growth rate always has to be lower than the growth rate of the economy, otherwise given enough time the company will grow larger than the economy, which doesn’t quite make sense). So, given an annual return of 10% on your invested money, to get $10 million by year 3, right now, in your hand today you’d need $7.5 million.

Provides Insight Into a Company’s Future Performance

Payback analysis is usually used when companies have only a limited amount of funds (or liquidity) to invest in a project, and therefore need to know how quickly they can get back their investment. If you pay more than the DCF value, your rate of return will be lower than the discount. For a bond, the discount rate would be equal to the interest rate on the security. This is because the DDM assumes that all cash flows will be paid out as dividends. The dividend discount model (DDM) is a valuation method that is used to estimate the intrinsic value of a stock. In addition to the DCF model, there are other valuation methods that can be used to value a company.

Pros of the Discounted Cash Flow Model

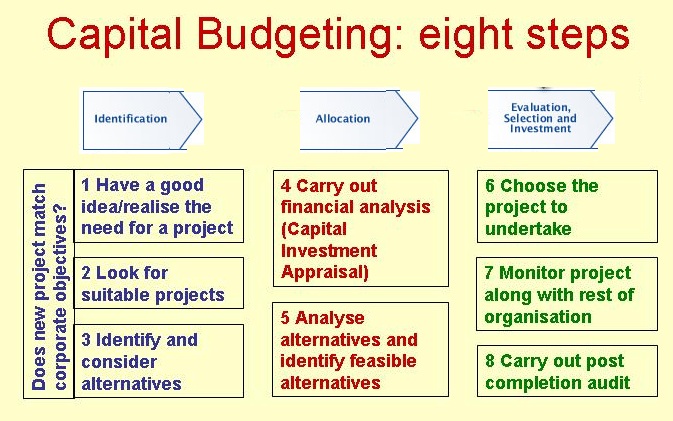

These decisions consider factors like patient demand, regulatory requirements, and technological advancements. Organizations become more proactive in identifying and evaluating different ways to fund essential projects while managing resource constraints. This holistic approach helps ensure that the selected project portfolio delivers maximum value for the organization. Organizations under capital constraints must develop more sophisticated resource allocation strategies to maximize the utility of available funds. This alignment ensures that limited resources are directed toward initiatives that support the organization’s strategic direction and competitive positioning. Projects must demonstrate clear connections to core business objectives and long-term growth plans.

Project duration

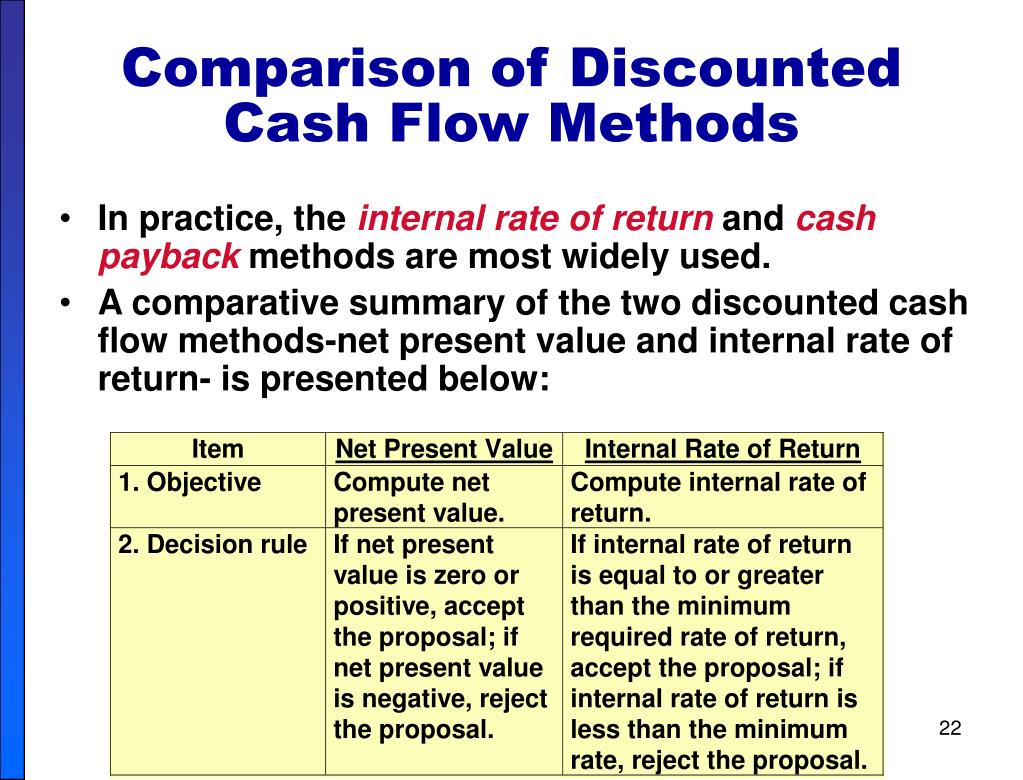

In assessing the profitability of an investment using the DCF model, the resulting DCF should be higher than the initial cost for such investment to be considered profitable. These cash flows are then discounted back to present value, and the resulting figure is divided by the number of shares outstanding. The cash flow that is being discounted can be from any source, such as earnings, dividends, or even cash that will be generated from the sale of an asset. If present value of cash inflow is equal to present value of cash outflow, the net present value is said to be zero and the investment proposal is considered to be acceptable.

Do you already work with a financial advisor?

Discount rates reflect the fundamental principle that money available now is worth more than the same amount in the future. When projects exceed the hurdle rate, they become how to use your tax refund to build your emergency funds candidates for investment consideration. This conversion accounts for the time value of money and risk factors, providing a more realistic assessment of project value.

How to Calculate a DCF MODEL IN EXCEL

In this case, Rayford Machining would not invest, since the outcome is negative. The negative NPV value does not mean the investment would be unprofitable; rather, it means the investment does not return the desired 5% the company is looking for in the investments that it makes. The following example illustrates the computation of both simple and discounted payback period as well as explains how the two analysis approaches differ from each other. Once you have added all your future discounted cash flows together, you get the value of the business today.

- Capital constraints lead to more thorough risk assessment processes as organizations cannot afford project failures.

- Companies should evaluate each investment decision in the context of alternative uses of capital and potential lost opportunities.

- The dividend discount model (DDM) is a valuation method that is used to estimate the intrinsic value of a stock.

- The discounted cash flow (DCF) formula is equal to the sum of the cash flow in each period divided by one plus the discount rate (WACC) raised to the power of the period number.

- Specifically, the first year’s cash flow is worth $90.91 today, the second year’s cash flow is worth $82.64 today, and the third year’s cash flow is worth $75.13 today.

We find the present value factor in the present value table in the row with the corresponding number of periods (n). When cash flows are equal, use the Present Value of an Ordinary Annuity table to find IRR. The important figure there is r, which we’re using as the discount rate in this whole equation. But here, we use what interest we could get from an alternative investment in the market, called the Market Rate. This is the rate of return you’d get if you invested your money today instead. Throughput analysis is the most complicated method of capital budgeting analysis, but it’s also the most accurate in helping managers decide which projects to pursue.

For example, if an investor requires a higher return, they can simply adjust the discount rate accordingly. This is because the DCF model considers all of the factors that affect a company’s value, such as its growth potential and riskiness. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation.