Mastering the Market: A Deep Dive into Pocket Option Robot Strategy

In today’s fast-paced financial trading landscape, the pocket option robot strategy pocket option robot strategy has emerged as a game-changing tool for traders seeking to leverage automated systems to maximize their profits and minimize risks. This article delves into the intricate details of how these trading robots function, the strategies involved, and the potential benefits and drawbacks of incorporating such technology into your trading regimen.

Understanding Pocket Option and Automated Trading

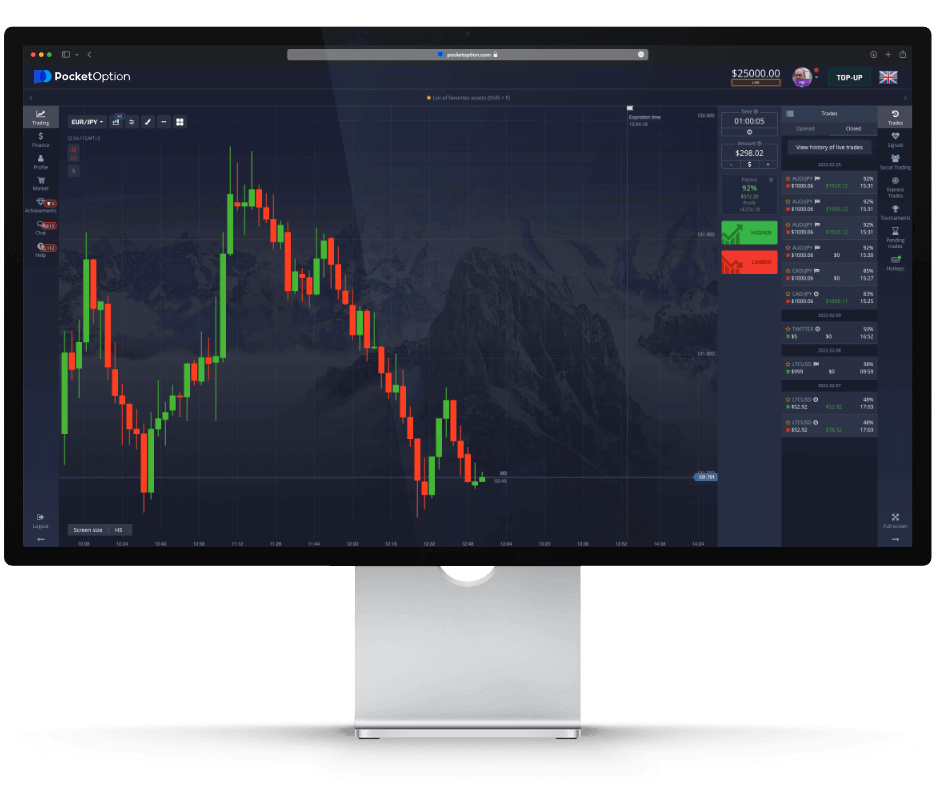

Pocket Option is an innovative trading platform that has garnered attention for its user-friendly interface and diverse range of trading options. One of the standout features of Pocket Option is its compatibility with automated trading systems, commonly referred to as trading robots. These robots are designed to execute trades based on predefined algorithms and parameters set by the trader. The primary advantage of using a trading robot is its ability to analyze market trends and execute trades at speeds unattainable by human traders.

How Trading Robots Work

At the core of any trading robot is its algorithm, which is programmed to analyze various market indicators, patterns, and data points. The robot continuously scans the market for trading opportunities that align with the trader’s strategy. Upon identifying a favorable condition, it executes trades on behalf of the trader without requiring any manual input. The effectiveness of a trading robot largely hinges on the sophistication of its algorithm and the quality of the data analyzed.

Key Components of a Pocket Option Robot Strategy

When integrating a trading robot into your Pocket Option trading plan, several critical components should be considered to optimize outcomes:

- Algorithm Optimization: The effectiveness of a trading robot is directly related to the quality of its algorithm. Traders should continuously test and optimize their algorithms based on historical data and current market conditions.

- Risk Management: A successful pocket option robot strategy must incorporate effective risk management techniques, including proper position sizing and stop-loss strategies, to minimize potential losses while maximizing profits.

- Market Analysis: Understanding the types of market analysis that the robot utilizes—be it technical analysis, fundamental analysis, or a combination of both—can help traders make informed decisions about when to enter or exit positions.

- Parameter Settings: Adjusting the parameters of the robot to suit individual trading preferences and market conditions is essential. This may involve settings related to trade size, asset selection, and the frequency of trades.

Benefits of Using a Pocket Option Robot Strategy

Traders who adopt a pocket option robot strategy can enjoy several benefits:

- Time Efficiency: Automated trading allows for less time spent on market analysis and execution, freeing up valuable time for other endeavors.

- Emotionless Trading: Trading robots eliminate emotional decision-making, which can lead to more rational and consistent trading outcomes.

- 24/7 Market Monitoring: Unlike human traders, robots can monitor the markets continuously, allowing for the exploitation of opportunities that may arise at any time.

- Backtesting Capabilities: Most trading robots offer backtesting features, enabling traders to test strategies on historical data before deploying them in live markets.

Challenges and Risks Involved

While the advantages of using a pocket option robot strategy are compelling, it’s crucial to acknowledge the associated challenges and risks:

- Market Volatility: Unexpected market movements can significantly affect the performance of trading robots. Robots may not adapt quickly to sudden changes, leading to potential losses.

- Reliance on Technology: Technical issues, such as server outages or software bugs, can disrupt trading and lead to missed opportunities or losses.

- Algorithm Inflexibility: Rigid algorithms may fail to adjust to evolving market conditions, necessitating regular updates and optimizations to remain effective.

- Cost Implications: Advanced trading robots often come with upfront costs or subscription fees, which may not align with every trader’s budget.

Choosing the Right Pocket Option Robot

When selecting a pocket option robot, traders should conduct thorough research to identify solutions that align with their trading style, risk tolerance, and financial goals. Key factors to consider include:

- Reputation and Reviews: Look for robots with a proven track record and positive user feedback.

- Customizability: Choose robots that allow for parameter adjustments and strategy customization to suit your trading needs.

- Customer Support: Reliable customer support can be invaluable in resolving issues that may arise during trading.

- Trial Periods: Opt for robots that offer trial periods, allowing you to test the system without committing a significant investment.

Conclusion

The integration of a pocket option robot strategy into your trading arsenal can enhance your trading experience by providing invaluable insights and automating routine tasks. However, successful implementation requires a comprehensive understanding of market dynamics, constant algorithm optimization, and risk management. As with any investment strategy, it is crucial to remain informed and adaptable in the ever-evolving landscape of trading.