When deciding how to maintain control over physical inventory, it’s prudent to carefully weigh both the pros and cons of any system under consideration. The cost of goods sold includes elements like direct labor and materials costs and direct factory overhead costs. Let’s say Ava, a product manager, wants to know if she is pricing generic Acetaminophen high enough to leave a healthy profit margin. If she calculates the COGS as $10 per 100-capsule bottle, she will need to price each bottle higher than $10 so her company can comfortably turn a profit. Danielle Bauter is a writer for the Accounting division of Fit Small Business.

What Is the Periodic Inventory System?

For instance, grocery stores or pharmacies tend to use perpetual inventory systems. With perpetual LIFO the costs of the latest purchases as of the date of each sale are removed first. At the time of the sale on September 1, the latest cost of the 3 units sold was $11 each. Using perpetual LIFO, the company’s cost of goods sold will be $43 (1 at $10 and 3 at $11), and its inventory will be reported at a cost of $32 (2 units at $11 and 1 unit at $10). Assume that a company’s accounting year is January 1 through December 31 and the company sells only one type of product. In summary, the company had 2 units on January 1, purchased 5 units on April 1, sold 4 units during the year, and has 3 units on hand at December 31.

Does Amazon Use Periodic or Perpetual Inventory?

A periodic inventory system updates and recordsthe inventory account at certain, scheduled times at the end of anoperating cycle. The update and recognition could occur at the endof the month, quarter, and year. There is a gap between the sale orpurchase of inventory and when the inventory schedule b form report of tax liability for semiweekly schedule depositors activity isrecognized. A perpetual inventory system automaticallyupdates and records the inventory account every time a sale, orpurchase of inventory occurs. You can consider this “recording asyou go.” The recognition of each sale or purchase happensimmediately upon sale or purchase.

- As with the periodic system, observe that the perpetual system also produced the lowest gross profit via LIFO, the highest with FIFO, and the moving-average fell in between.

- For example, consider stocking the shelves in a food store, where a customer purchases the item in front, which was likely to be the last item added to the shelf by a clerk.

- She will use this information to calculate the ending inventory and COGS for the period.

Moving Average

With this application, customers havepayment flexibility, and businesses can make present decisions topositively affect growth. The key difference between the two lies in the timing of the inventory valuation and update. In Perpetual LIFO, inventory updates and valuations occur continually with each transaction, providing a more real-time view of inventory levels and costs. This means that the periodic average cost is calculated after the year is over—after all the purchases for the year have occurred. This average cost is then applied to the units sold during the year and to the units in inventory at the end of the year. Perpetual inventory and periodic inventory are both accounting methods used by businesses to track the number of products they have available.

One cost $110 while the other three were acquired for $120 each or $360 in total. Total cost was $470 ($110 + $360) for these four units for a new average of $117.50 ($470/4 units). The applicable average at the time of sale is transferred from inventory to cost of goods sold at points A ($110.00), B ($117.50), and C ($126.88) below. When a sales return occurs, perpetual inventory systems requirerecognition of the inventory’s condition.

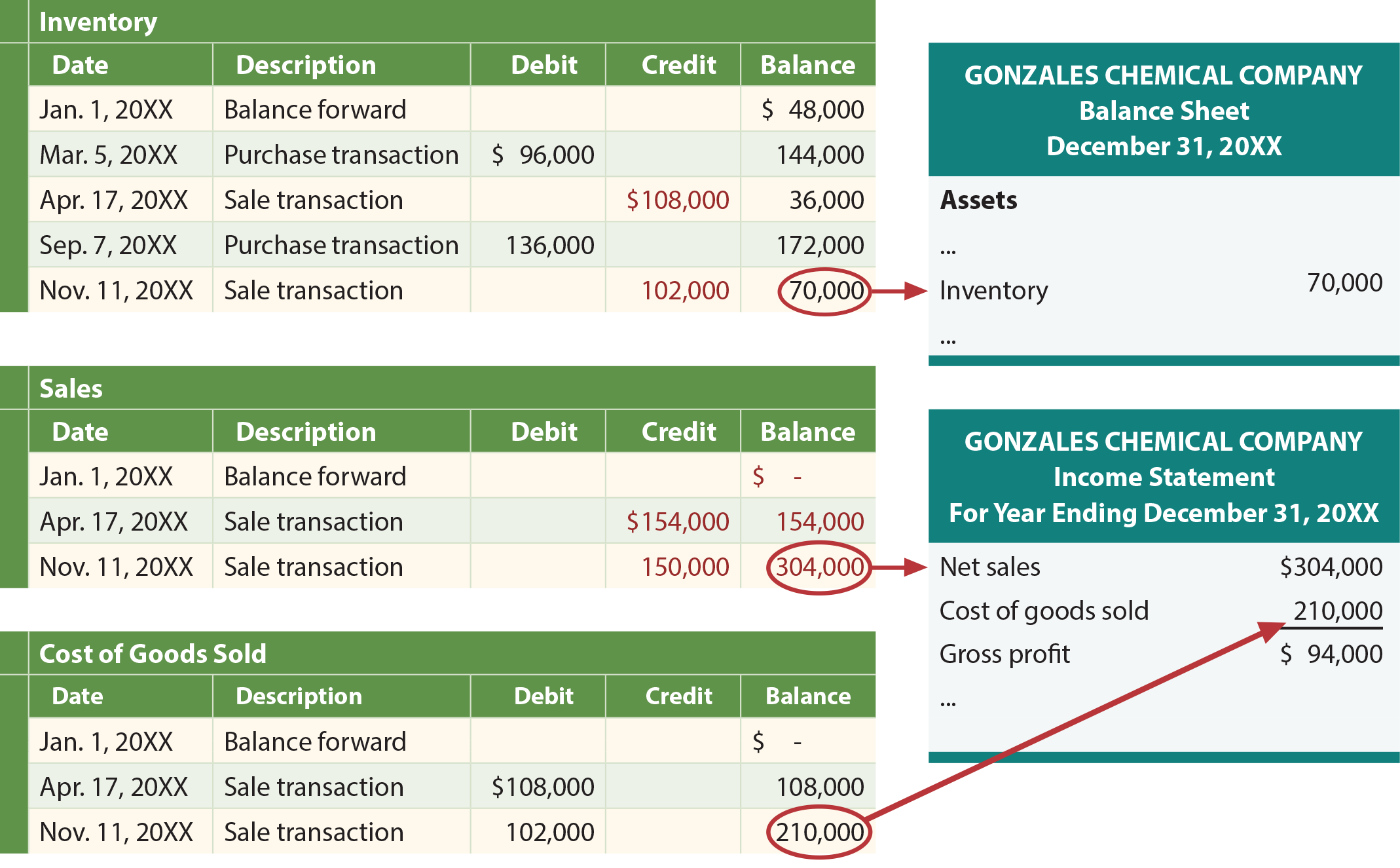

The periodic inventory system requires a calculation to determine the cost of goods sold. The six inventory systems shown here for Mayberry Home Improvement Store provide a number of distinct pictures of ending inventory and cost of goods sold. As stated earlier, these numbers are all fairly presented but only in conformity with the specified principles being applied. Two bathtubs were sold on September 9 but the identity of the specific costs to be transferred depends on the date on which the determination is made. A periodic system views the costs from the perspective of the end of the year, while perpetual does so immediately when a sale is made.

As we can see, the difference between the periodic and the perpetual systems under the weighted average cost method is only $364. Since the items in the example (LCD screens) are interchangeable, and it was not clearly disclosed which batch was sold first, we would assume that the company followed a first in, first-out basis. Under this assumption, the ending inventory and gross profit would be the same as they are under FIFO. The following example can help illustrate how the calculation of the cost of sales, gross profit, and ending inventory will differ under the four inventory valuation methods. In other words, the ending inventory was counted and costs were assigned only at the end of the period. With a perpetual system, a running count of goods on hand is maintained at all times.

On the other hand, detractors don’t necessarily note that reported stockouts without corresponding sales can signal theft or loss and trigger a physical inventory check faster than with a periodic system. Ava’s business uses the calendar year (starting on Jan. 1 and ending Dec. 31) for recording inventory. The company accountant valued the Jan. 1 beginning inventory of generic Acetaminophen at $49,000, or 4,900 bottles.